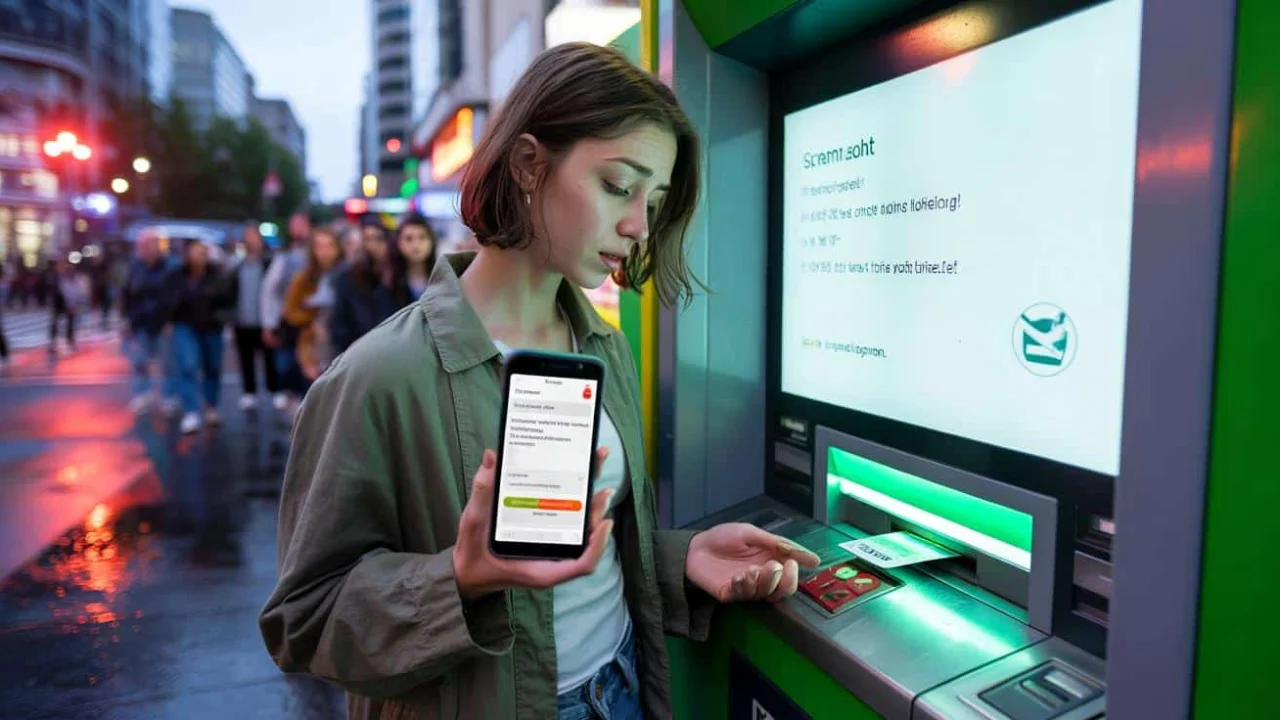

Sarah was running late for her daughter’s birthday party when the ATM screen went dark. She’d inserted her card, entered her PIN, and waited for the familiar whir of cash dispensing. Instead, silence. The machine had swallowed her debit card whole, leaving her staring at an error message with twenty kids expecting cake in an hour.

Behind her, a line of weekend shoppers shuffled impatiently. The bank branch was closed. Her phone showed three missed calls from the party venue. That sinking feeling in her stomach wasn’t just about the inconvenience – it was the helplessness of watching a machine hold your financial lifeline hostage.

What Sarah didn’t know was that in the next sixty seconds, a simple technique could have freed her card before she ever had to dial the customer service number.

Why ATMs Actually Capture Your Card

ATMs don’t randomly decide to keep your card out of spite. These machines follow strict security protocols designed to protect both you and the bank. When something seems off – whether it’s a damaged magnetic strip, suspicious activity, or even just taking too long to complete a transaction – the ATM’s default response is to retain the card.

- One Simple Baseboard Trick Cuts Your Entire Cleaning Time By 40% (Most People Skip This Step)

- Hair stylists are quietly warning clients about this dyeing mistake that’s ruining hair faster than expected

- Birth order shapes your personality more than your DNA, new research reveals

- One friend’s plastic wrap trick keeps bananas yellow for 14 days while yours turn brown in 3

- This February inheritance law update catches most heirs completely unprepared

- Experts Finally Admit 19°C Indoor Temperature Rule Was Wrong – Here’s What They Actually Recommend

“Most people think the machine is broken when it keeps their card, but it’s actually doing exactly what it’s programmed to do,” explains Marcus Chen, a former ATM technician with fifteen years of experience. “The machine would rather be safe than sorry.”

The retention mechanism works like a mechanical trap door. Once triggered, metal clamps grab your card and pull it into an internal storage compartment. From the outside, it feels instant and final. But inside the machine, there’s actually a brief processing window where the card hasn’t been fully secured yet.

Common triggers for card retention include:

- Leaving the card inserted for more than 30 seconds without action

- Multiple incorrect PIN attempts

- Network connectivity issues during transaction processing

- Worn or damaged magnetic strips that can’t be read properly

- Suspected fraudulent activity on the account

The Emergency ATM Card Retrieval Method

Here’s the technique that most people never learn: immediately after your card gets captured, rapidly press the “Cancel” button multiple times while simultaneously pressing and holding any other button on the keypad. The most effective combination appears to be Cancel + Clear, pressed in quick succession about 5-7 times.

This works because many ATM models have a brief “decision period” after card capture where the internal mechanism hasn’t fully completed its retention sequence. The rapid button combination can sometimes trigger the machine to reverse its decision and eject the card.

| Timing | Success Rate | Action Required |

|---|---|---|

| Within 10 seconds | 60-70% | Cancel + Clear buttons rapidly |

| 10-30 seconds | 30-40% | Multiple button combinations |

| After 30 seconds | 5-10% | Contact bank required |

“I’ve seen this work more times than I can count,” says Jennifer Rodriguez, a bank branch manager in Dallas. “The key is acting fast. Once the machine has fully processed the retention, you’re out of luck until we can manually retrieve it.”

Some ATM models respond better to different button combinations. If Cancel + Clear doesn’t work within the first few attempts, try these alternatives:

- Enter + Cancel pressed simultaneously

- Pressing all numeric buttons (1-9) in rapid sequence

- Holding down the Cancel button for 10 seconds straight

What Happens When the Quick Fix Doesn’t Work

When the emergency retrieval technique fails, you’re looking at a more complicated process. Most banks require cards to be manually removed by trained personnel, which can take anywhere from a few hours to several business days depending on the location and timing.

The frustration compounds quickly. Weekend incidents often can’t be resolved until Monday. Rural ATM locations might take even longer since they require special service calls. Meanwhile, you’re stuck without access to your primary account.

“Friday evening card retentions are the worst,” admits David Park, a customer service representative at a major national bank. “People are trying to get cash for weekend plans, the branches are closed, and they’re looking at days without their card.”

During peak times, customer service wait times can stretch to over an hour. Even when you reach someone, they often can’t do much beyond confirming that your card is indeed trapped and initiating a replacement request.

The financial impact extends beyond inconvenience. Many people rely on their primary debit card for automatic payments, online purchases, and daily transactions. A retained card can trigger missed payments, overdraft fees, and the headache of updating payment information across multiple accounts.

Prevention Strategies That Actually Work

The best ATM card retrieval strategy is never needing one in the first place. Simple prevention habits can dramatically reduce your chances of card retention.

Always have your PIN memorized and ready before inserting your card. Hesitation and multiple attempts are red flags for ATM security systems. If you’re unsure about your PIN, check it using your bank’s mobile app or online banking before approaching the machine.

Check your card’s physical condition regularly. Scratched magnetic strips, bent corners, or worn chip contacts can cause reading errors that trigger retention. Most banks will replace damaged cards free of charge before they become a problem.

Choose your ATM timing wisely. Late Friday afternoons, holiday weekends, and the last few days of the month see the highest card retention rates. If possible, conduct your banking during normal business hours when help is readily available.

“I tell customers to treat ATM visits like driving in bad weather,” explains Rodriguez. “Give yourself extra time, stay focused, and have a backup plan ready.”

Keep your bank’s customer service number stored in your phone contacts. When card retention happens, every minute counts for both the emergency technique and getting professional help.

FAQs

How long do I have to try the emergency retrieval technique?

You typically have 10-30 seconds before the ATM fully processes the card retention, with the highest success rates in the first 10 seconds.

Will pressing buttons damage the ATM or my card?

No, the button combinations won’t harm either the machine or your card, as you’re only using the ATM’s normal input functions.

What if the technique works but the ATM still won’t dispense cash?

Take your retrieved card and try a different ATM, as the original machine likely has a technical issue that caused the initial retention.

Can I try the technique multiple times?

Yes, but effectiveness decreases rapidly after the first 30 seconds, so don’t spend more than a minute attempting the emergency retrieval.

Should I try to physically retrieve my card from the slot?

Never attempt to physically extract a retained card with tools or force, as this can damage both the ATM and your card permanently.

How quickly can the bank replace a retained card?

Most banks can issue temporary cards within 24-48 hours, while permanent replacements typically take 5-7 business days to arrive by mail.